The federal Historic Tax Credit (HTC) is a financial tool intended to spur the preservation and redevelopment of historic properties. Originally established in 1976, the HTC program has undergone various revisions as a result of subsequent tax reform. Today, the 20% HTC is an important tool for affordable housing, community revitalization, and historic preservation.

1The HTC program is a non-competitive process with an application process administered by the National Park Service. Approved projects are eligible for a 20% HTC that is required to be taken over five years. Much like the low-income housing tax credit (LIHTC), HTCs are often sold to investors, in effect generating equity in a project.

To quality for HTCs, a building and project must meet a few key criteria:

- It must be income-producing (and must remain so five years after the completion of the rehab).

- It must be a “certified historic structure” as determined by the National Park Service. This means that a building is listed on the National Register of Historic Places or acts as a contributing factor to a historic district.

- The project rehab must be in accordance with the Secretary of the Interior’s Standards for Rehabilitation (Secretary’s Standards). This is reviewed by both the National Park Service and the respective State Historic Preservation Office (SHPO).

- The rehab of the building must be considered “substantial.” The IRS defines substantial as the qualified rehab expenditures exceeding the greater of $5,000 or the adjusted basis of the building.

The HTC application process begins once the National Register status of the building has been confirmed. While this can vary, depending on the status, there are three parts to the HTC applications:

- Part 1: This phase confirms the National Register status of a building. If it’s not a certified historic structure or contributing to a historic district, extensive research will be crafted into a narrative to support this claim.

- Part 2: This phase confirms the scope of work for the rehab meets the Secretary’s Standards.

- Part 3: This phase confirms the Secretary’s Standards have been met following the completion of construction.

Typically, the review of a complete application will take 60 to 90 days. Also, while not required, it’s a best practice to begin construction following the approval of Part 2.

For multi-family affordable housing developers, the HTC can help fill in their capital stack and create greater equity in a project. That said, one should be prudent about the challenges in “twinning” historic and low-income housing tax credits. They are certain to encounter hurdles in timing and schedule, construction costs, and design requirements.

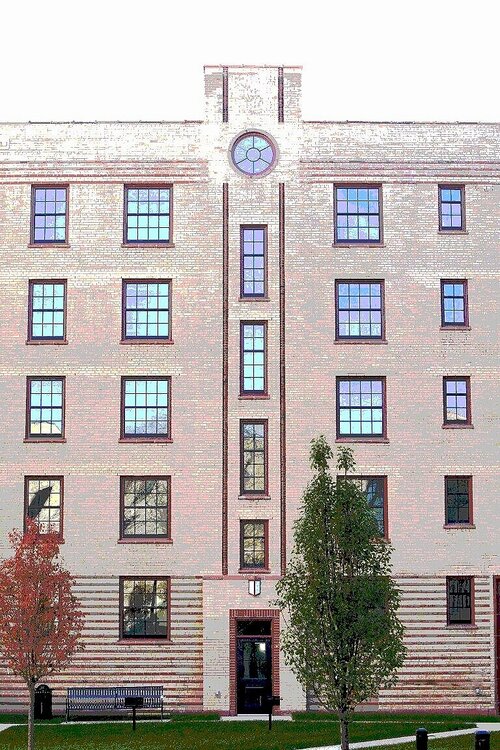

As challenging as they may be, these types of projects often carry extra significance as they repurpose important cultural landmarks, give new life to communities, and create affordable housing. Consider the award-winning Rosenwald Courts Apartments in Chicago. An HDJ project, this rehab was completed in 2016 and has been an important addition to Chicago’s Southside. HDJ is experienced in providing successful outcomes with Historic Tax Credit projects.

HDJ, Inc. is a leading national design firm providing architectural and engineering expertise to support the affordable housing industry throughout the United States. HDJ’s diverse portfolio includes successful outcomes with adaptive reuse renovation, acquisition rehab, new construction, historic preservation and RAD. Contact HDJ to learn more about how we can support your affordable housing needs.

Author: Josh Hahn